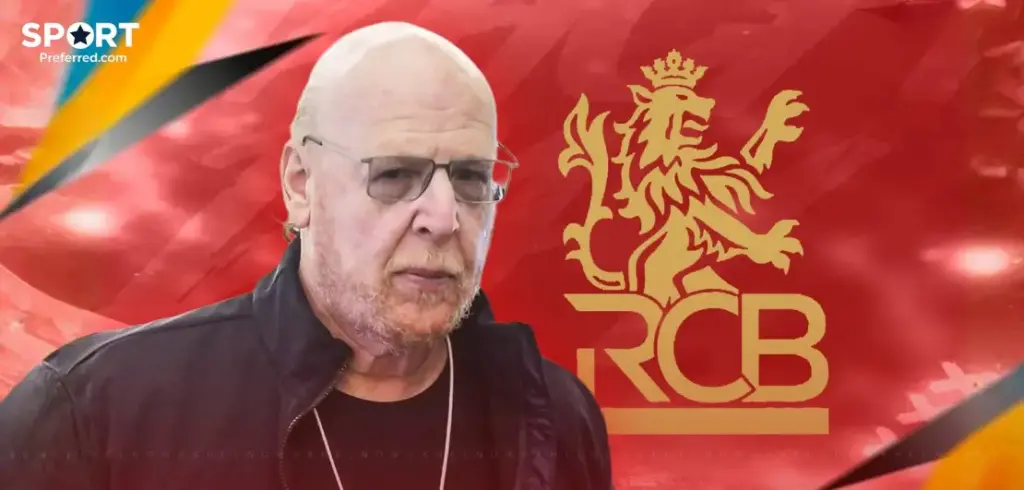

The Indian Premier League (IPL) has entered a new financial era as Avram Glazer, co-owner of Manchester United, has submitted a bid of around $1.8 billion (approx. ₹14,900 crore) to acquire Royal Challengers Bengaluru (RCB).

The potential deal could value the franchise at up to $2 billion, highlighting how IPL teams have become some of the most valuable sports assets in the world.

The Big Development: Glazer Enters the Race for RCB

Avram Glazer has officially joined the list of global investors looking to buy a stake in RCB. The current owner, Diageo Plc, is exploring options to sell either a minority stake or the entire franchise.

Key points of the development:

| Detail | Information |

|---|---|

| Bid Amount | Around $1.8 billion |

| Expected Valuation | Up to $2 billion |

| Current Owner | Diageo Plc |

| Decision Timeline | Shortlist expected in coming weeks |

Diageo has not commented publicly, and Glazer has also not issued an official statement. However, the bidding process is moving forward, and final contenders are expected to be narrowed down soon.

Other Major Investors in the Race

Glazer is not the only big name interested in the franchise. The strong demand reflects the growing global appeal of IPL.

Potential bidders include:

- Private equity firms like Blackstone and Carlyle

- Indian business groups and industrialists

- Global sports investors looking to enter cricket

This level of competition shows how IPL franchises are now viewed similarly to major football and American sports teams.

Interestingly, RCB’s value is not just based on on-field success. The franchise’s strength comes from its brand power.

Factors behind RCB’s high valuation:

- One of the IPL’s founding teams

- Massive fan following across India and globally

- Strong commercial partnerships and sponsorships

- High digital and social media engagement

- Star player legacy and strong brand identity

In modern franchise sports, brand reach and commercial strength matter as much as trophies.

IPL’s Financial Growth: From Millions to Billions

IPL franchise values have grown rapidly over the past few years.

| Year | Transaction | Value |

|---|---|---|

| 2021 | Lucknow Super Giants bought by RPSG | $940 million |

| 2026 (Expected) | RCB potential sale | Up to $2 billion |

If the RCB deal crosses the $2 billion mark, it will set a new benchmark and increase the valuation of all IPL teams.

Avram Glazer’s Interest in Cricket

This is not Glazer’s first move in cricket.

His cricket investments and attempts:

- Bid for IPL expansion team in 2021 (unsuccessful)

- Purchased Desert Vipers franchise in UAE league

- Explored opportunities in England’s short-format competitions

The current RCB bid shows his long-term interest in building a global cricket portfolio.

Eighteen seasons after its launch, the IPL is no longer just cricket’s biggest tournament. It has become one of the most valuable leagues in global sport.

The intense bidding for RCB shows that the world’s biggest investors now see IPL franchises as long-term, high-growth assets. And if the deal crosses the $2 billion mark, it could reshape the financial landscape of franchise cricket for years to come.